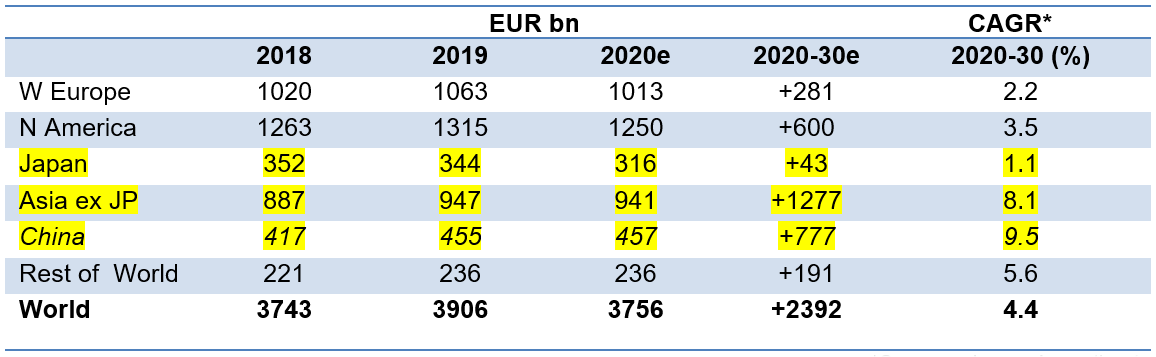

- In 2019, global insurance premiums increased by 4.4% to EUR 3,906bn – clocking the strongest growth in four years

- Asia (ex Japan) was setting the pace with 6.8% and total premiums reached EUR 947bn – with China being responsible for almost half of all premiums written in the region

- 2020 will be different: Premium income is expected to shrink by 0.7% in Asia (ex Japan) and by 3.8% globally – compared with the pre-Covid-19 trend, around EUR 360bn in premiums will go missing

- Most markets will recover in 2021 and global growth over the next decade should settle down at 4.4%, against 8.1% in Asia (ex Japan) – the region will contribute more than 50% or EUR 1,277bn to global premium growth until 2030

Allianz Global Insurance Report 2020: Asia Will Emerge Stronger from the Crisis

SINGAPORE, 2 July, 2020

- Today, Allianz unveiled its latest Global Insurance Report, taking the pulse of insurance markets around the world by looking back at last year’s performance and looking ahead at future developments.[1]

- The global insurance industry entered 2020 in good shape: In 2019, premiums increased by 4.4%, the strongest growth in four years. The increase was driven by the life segment where growth sharply increased over 2018 to 4.4%, as China overcame its temporary, regulatory-induced setback and mature markets came finally to grips with low interest rates. Property-casualty insurance clocked almost the same rate of growth (4.3%), down from 5.4% in 2018. Thus, for the first time since 2015, life insurance outgrew the P&C segment, albeit by a very thin margin. Global premium income totaled EUR 3,906bn in 2019 (Life: EUR 2,399bn, P&C: EUR1,507bn).

- Then, Covid-19 hit the world economy like a meteorite. The sudden stop of economic activity around the globe will batter insurance demand, too: Global premium income is expected to shrink by 3.8% in 2020, with life insurance probably hit more than P&C business with growth rates of -4.4% and -2.9%, respectively. Thus, the impact of the Corona pandemic is going to be three times stronger than that of the global financial crisis, when global premium income decreased by 1.0%. Compared to the pre-Covid-19 growth trend, the pandemic will shave around EUR 360bn from the global premium pool (Life: EUR 250bn, P&C: EUR 110bn).

- “2020 is lost to the virus, no doubt about it,” said Ludovic Subran, chief economist of Allianz. “More interesting is the question about what comes after Covid-19. Basically, we see three trends, already in place before, that will gather steam in the coming years: Digitalization of the business model, the pivot to Asia and the growing significance of ESG-factors. While Asian players lead in technology, European peers are ahead with ESG. But dominance of the global insurance industry will be decided in Asia – Asian households emerge as the consumer of last resort, driving global insurance demand.”

- In fact, Asia (ex Japan) clocked growth of 6.8% in 2019, more than twice the rate of the year before. Both segments, Life and P&C, contributed to the increase in premiums: Life grew by 6.5% and P&C by 7.5%. Total premiums reached EUR 947bn in the region, almost half of them written in China.

- However, 2020 will be challenging for Asia: Premium income is expected to decline by 0.7%, with life insurance shrinking by 1.8% and P&C still slightly growing by 1.9%. Long-term prospects look brighter - the region will return to its “normal” growth and see an average growth rate p.a. of 8.1% until 2030; life and P&C are expected to grow at the same speed. This is almost twice the speed of the global market (4.4%).

- “Asia was the region first hit by Covid-19; it will also be the region that recovers first,” said Michaela Grimm, Allianz SE economist and co-author of the report. “Higher risk awareness and pent-up demand for social protection will drive growth in the coming years, with China in the lead: For the next couple of years, we expect double-digit increases in premiums in the Middle Kingdom. Up to 2030, China’s premium pool will grow by a whopping EUR 777bn – the market size of UK, France, Germany and Italy combined. China and Asia will emerge even stronger than before from today’s crisis.”

- Insurance premiums in property-casualty and life*

*Compound annual growth rate

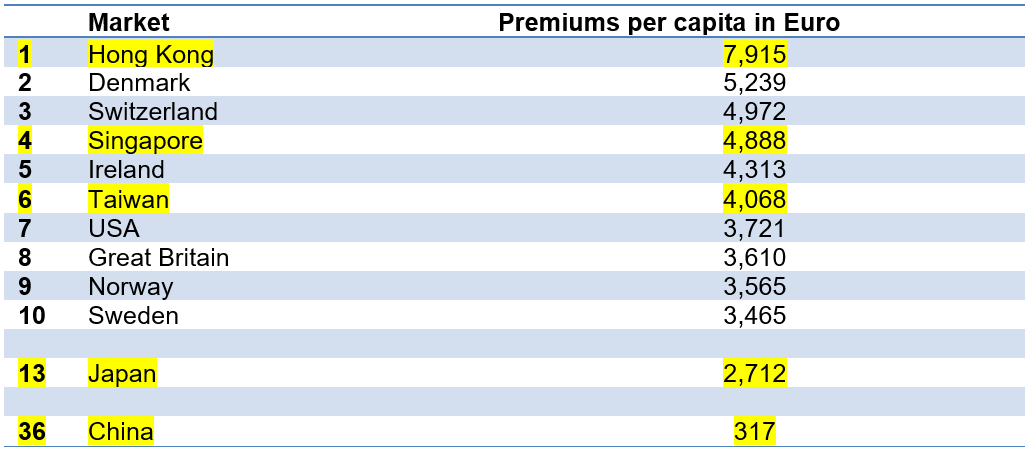

Insurance markets by life and property-casualty premiums per capita in 2019*

*based on 2019 exchange rates