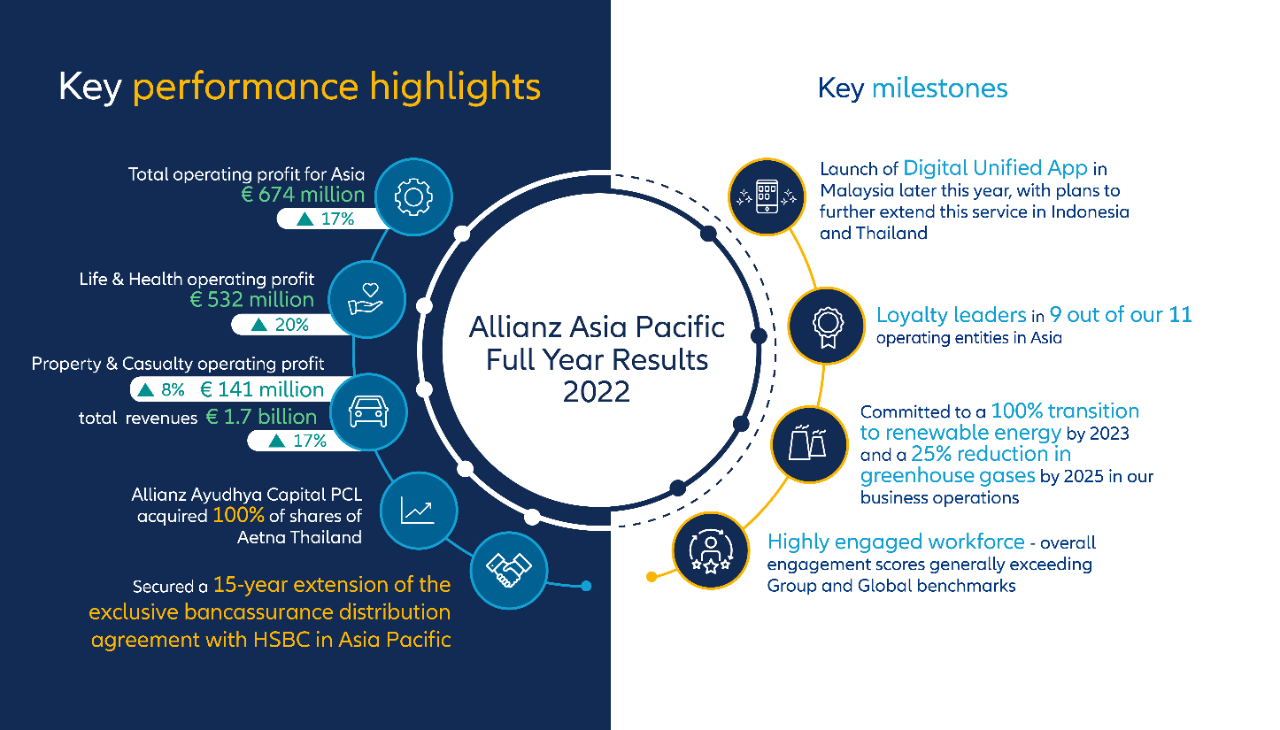

- Total operating profit for Asia up 17 per cent to EUR 674 million

- Life & Health operating profit up 20 per cent to EUR 532 million

- Property & Casualty operating profit up 8 per cent to EUR 141 million, with total revenues up 17 percent to EUR 1.7 billion

- 9 out 11 of our operating entities conferred as Loyalty Leaders

- Allianz Ayudhya Capital PCL (AYUD)’s 100 per cent acquisition of Aetna Thailand

- Secured a 15-year extension of the exclusive bancassurance distribution agreement with HSBC in Asia Pacific, covering key markets

All OP figures include India at equity; results exclude global lines

Anusha Thavarajah, Regional Chief Executive Officer, Allianz Asia Pacific, said: “Allianz Asia Pacific’s strategy to focus on Distribution and Customer through delivering the best in digital, products, and services has resulted in a strong and resilient performance amid difficult market conditions.

“We are committed to insure more people, ensuring that we meet their needs, and securing their futures. This will be done through continuous growth of our distribution - especially agency, and leveraging on the strength of the Allianz Group to build unrivalled propositions, underpinned by the integration of sustainability (ESG) aspects in our business.

“Asia as a region has always been synonymous with boundless promise, potential, and opportunity. As the outlook for the region improves, the shift in market dynamics and changing consumer behaviours impact the way the Asian consumer demands insurance.

“Our excellent track record in Asia, and with 9 out of 11 of our operating entities being “Loyalty Leaders”, affirms our customers’ trust in our brand and service. We are confident that we will meet the increasing demands of customers and fully capitalize on Asia's growth opportunity.”

Aaron Fryer, Regional Chief Financial Officer, Allianz Asia Pacific, said: “In a year of uncertainty and amid a turbulent global economy, our core businesses have displayed resilience and performed in line with expectations, achieving a 17 percent increase in operating profits in Asia in FY2022.

“The Life & Health (L/H) business saw robust growth, with operating profit up 20 per cent to EUR 532 million, primarily due to profit increases in Taiwan, Malaysia, and China.

“The Property & Casualty (P/C) business in the region showed continuous growth, with operating profit up 8 per cent to EUR 141 million, while total revenues rose 17 per cent to EUR 1.7 billion, driven particularly by strong growth in China, Malaysia, Singapore, and Thailand (including the acquisition of Aetna Thailand).

“The growth was driven by strong momentum across several operating entities. While the year ahead may present its challenges, we have positioned ourselves well for sustainable growth.”

Allianz Asia Pacific continues to focus on innovation with enhanced distribution capabilities and new products to strengthen our presence as a leading player in all our markets across Asia. We remain committed with efforts to underwrite high-quality business lines, together with pursuing endeavours in strengthening our agency force and strategic bancassurance partnerships.

Our focus on driving simplicity at scale for the region, coupled with investments in technology have also yielded positive results with higher automation and straight-through-processing, allowing us to provide a more seamless experience for our employees, customers, and distribution partners.

Meanwhile, the strength and diversity of our businesses in Asia allow us to leverage the Group’s technical excellence, investment management, and fund management expertise to manage and diversify both our risks and investment returns. This remains a unique value proposition of Allianz, and we continue to tap into these resources to drive value creation for our customers in Asia Pacific.

Strategic Partnership and Market Expansion

Throughout 2022, Allianz Asia Pacific has continued to capitalise on existing and new opportunities to increase our market share in key growth markets and expand product offerings.

The acquisition of Aetna Thailand, a prominent player in the Thai health insurance market, by Allianz Ayudhya Capital PCL has simultaneously expanded our market share into the Thai health insurance market significantly, broadened the range of insurance solutions to customers, and unlocked considerable growth potential. This led to an up-lift in market ranking by three positions for our general insurance business in Thailand.

The renewal of our exclusive bancassurance distribution agreement with HSBC in Asia Pacific for another 15 years has reaffirmed a successful track record and demonstrated the commitment to provide best-in-class insurance products, as well as deliver a digitally-enabled insurance experience for customers across our major growth markets in Asia.

Transitioning to Net-Zero and Suatainable Future

In response to global environmental challenges, Allianz Group’s climate strategy was accelerated last year in April, reinforcing our commitment to limit greenhouse gas emissions from all our sites and activities globally to net-zero by 2030 instead of 2050 as originally planned.

Aligned with Allianz Group’s sustainability framework, within Asia, our regional operating entities remain committed to a 100 per cent transition to renewable energy by 2023 and a 25 per cent reduction in greenhouse gases by 2025 in our business operations.