- Annus horribilis: Global financial assets of private households declined by -2.7%, the strongest drop since the Global Financial Crisis (GFC)

- Wiped out: Three quarters of the nominal growth in financial assets over the last 20 years were eaten up by inflation – in Asia “only” two thirds

- No tailwinds: Average growth of global financial assets is likely to hover between 4% and 5% over the next three years

- Belt tightening: Growth in households’ liabilities fell sharply – in Asia it almost halved

- Singapore: growth slowed down but still positive at 3.2% in 2022

Munich, September 26, 2023

Today, Allianz unveiled the 14th edition of its “Global Wealth Report”, which puts the asset and debt situation of households in almost 60 countries under the microscope.

Annus horribilis

2022 was an annus horribilis for savers. Asset prices fell across the board in the "everything slump" scenario. The result was a dismal -2.7% decline in private households’ global financial assets1, the strongest drop since the Global Financial Crisis (GFC) in 2008. Growth rates of the three major asset classes, however, differed markedly. While securities (-7.3%) and insurance/pensions (-4.6%) saw strong setbacks, bank deposits showed robust growth at +6.0%. Overall, financial assets worth EUR 6.6 trillion were lost, total financial assets amounted to EUR 233 trillion at the end of 2022; EUR 63.9trn or 27% are owned by Asian households.

The decline was most pronounced in North America (-6.2%), followed by Western Europe

(-4.8%). Asia, on the other hand, still recorded relatively strong growth rates, the regional average stood at 4.6% in 2022, after 10.2% in 2021. Even Japan saw an increase, albeit a very small one (+0.2%). In contrast, emerging economies like Indonesia and the Philippines clocked double-digit growth. China's financial assets grew robustly, too, by 6.9%. But compared to the previous year (+13.3%) and the long-term average of the last 20 years (+15.9%), this was a rather disappointing development – repeated lockdowns clearly took their toll.

Wiped out

Despite bitter losses, global household financial assets were still nearly 19% above pre-Covid-19 levels at the end of last year – in nominal terms. Adjusted for inflation, almost two-thirds of (nominal) growth fell victim to price increases, reducing real growth to a meagre 6.6% in three years. While most regions could at least preserve real growth in wealth, the situation in Western Europe is different: Any nominal gains were wiped out, real wealth decreased by -2.6% over 2019. In Asia, on the other hand, the real plus is almost 20% over three years, thanks to subdued inflation, not least in China and Japan.

“For years, savers complained about zero interest rates.”, said Ludovic Subran, chief economist of Allianz. “But the real enemy of savers is inflation. And not only since the inflation surge after Covid-19. Even in Singapore inflation drives a big wedge between nominal and real growth: while assets per capita increased by 330% before inflation over the last 20 years, adjusted for purchasing power, the increase is a less impressive 130%. This underlines the need for smart saving and increased financial literacy. But inflation is a hard beast to beat. Without some nudges and professional advice for long-term savings most savers might struggle.”

No tailwinds

After the decline in 2022, global financial assets should return to growth in 2023. This is supported above all by the (so far) positive development on the stock markets. All in all, we expect global financial assets to increase by around 6%, also taking into account a further "normalization" of savings behavior. Given a global inflation rate of around 6% in 2023, savers should be spared another year of real losses on their financial assets.

“The mid-term outlook, however, is rather mixed.”, said Michaela Grimm, co-author of the report. “There will be no monetary or economic tailwinds to blow. Average growth of financial assets is likely to hover between 4% and 5% over the next three years, under the assumption of average stock markets returns. But like the weather, which gets more extreme amid climate change, more market swings are to be expected in the new geopolitical and economic landscape. ‘Normal’ years might rather become the exception.”

Belt tightening

The interest rate turnaround was also clearly felt on the liabilities side of the private household balance sheet. After global private debt had risen by 7.8% in 2021, growth weakened significantly last year to 5.7%. In Asia, debt growth almost halved, from 10.3% (2021) to 5.8% (2022). The sharpest fall was seen in China: last year's debt growth of +5.4% was the lowest growth on record. Overall, global household liabilities totaled EUR 55.8trn at the end of 2022, of which 32% or EUR 18.1trn are held by Asian households. As the gap between debt and economic growth widened to 3.9pp, the global debt-to-GDP ratio (liabilities as a percentage of GDP) has fallen significantly by more than 2pp to 66% in 2022. This means that the global debt ratio for private households is back at about the same level as it was at the beginning of the millennium – a remarkable level of stability that hardly fits the widespread narrative of a world drowning in debt. However, there have been major shifts in the world debt map. First and foremost, stability characterizes the development in advanced economies. On the other hand, most emerging markets have seen their debt ratios rise sharply over the last two decades. In Asia as a whole, the ratio stood at 61% at the end of 2022, some 7pp above the level 20 years ago. But this average marks some remarkable developments. In China, for example, the debt ratio has more than tripled to a good 61%.

Net financial assets, finally, declined by a hefty -5.2% worldwide, to EUR 176trn. Asia, however, saw an increase by 4.2% to EUR 46trn. But not all countries in the region saw positive growth after debt: in Japan, South Korea and Malaysia net financial assets declined, albeit by a small margin.

Singapore: solid growth

The gross financial assets of Singaporean households increased by 3.2% in 2022, markedly below the increase in the previous year (7.5%). The main cause was securities which grew by a dismal 0.5% (2021: 10.3%). Also, the development of the asset class insurance/pension – with a portfolio share of almost 50% the dominant asset class in Singapore – was rather disappointing: the increase of 2.8% was the smallest gain since the GFC. Bank deposits, on the other hand, grew by 5.1%, the same rate as the year before.

Compared to the pre-pandemic year of 2019, financial assets are 21.1% higher – but only in nominal terms. Adjusted for inflation, the increase is reduced by half to 11.8% in three years.

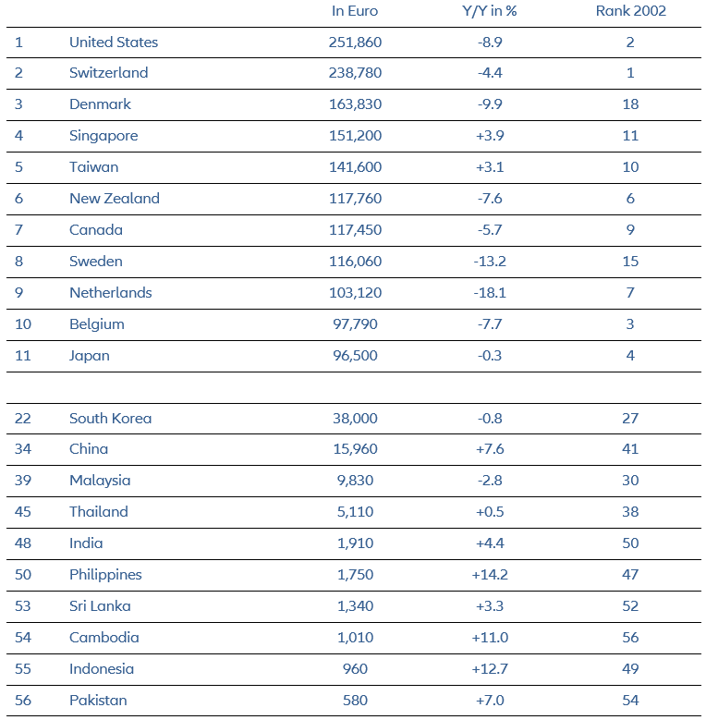

Growth in liabilities came almost to a standstill (+0.8), after rising briskly by 7.4% in 2021. As a result, the debt-to-GDP ratio fell by 7pp to 56%, the lowest ratio in this century. Net financial assets, finally, increased by 3.9%. With net financial assets per capita of EUR 151,200, Singapore remained at 4th position in the ranking of the richest countries; it is the richest country in Asia (financial assets per capita, see table).