- No respite: The aging of societies continues at an unabated pace – despite Covid 19

- Busy standstill: Pension systems worldwide resemble a large construction site with no prospect of completion – although only a few countries are prepared for the coming demographic changes

- Rethink: Society's reassessment of work is the key adjustment for the pension system of the future

- Singapore’s pension system scores 3.7 – long-term sustainability main reason for concern

Munich, April 19, 2023

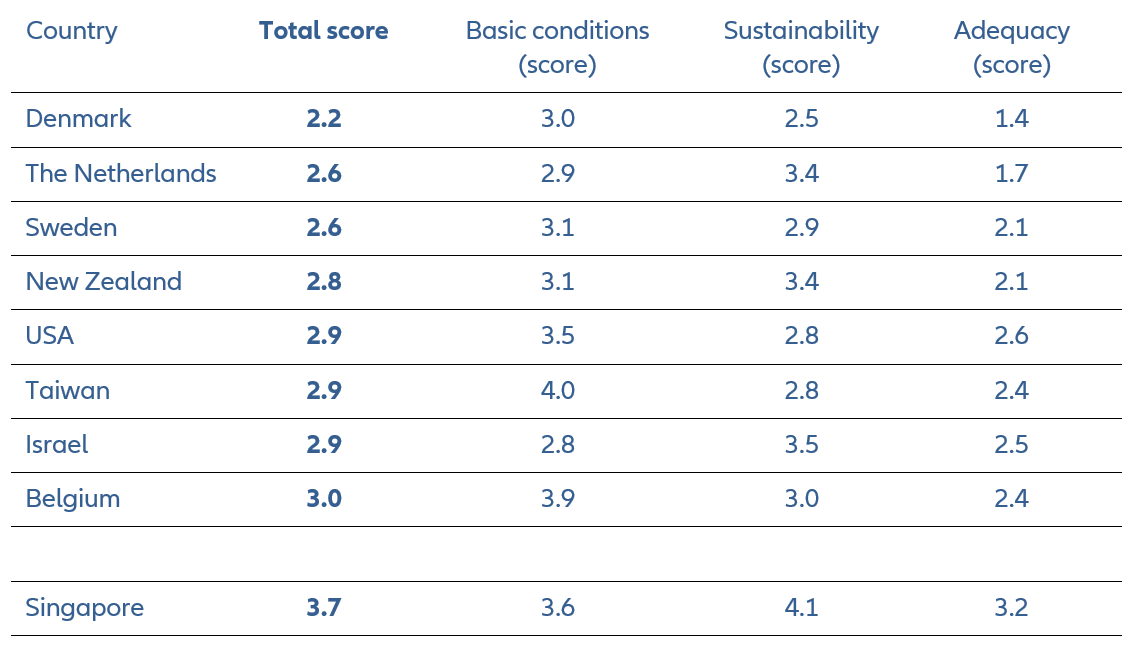

Allianz today launched the second edition of its Global Pension Report, which analyzes 75 pension systems around the globe using its proprietary Allianz Pension Index (API). The index consists of three pillars: Analysis of basic demographic and fiscal conditions as well as determination of the sustainability (e.g. funding and contribution periods) and adequacy (e.g. degree of diffusion and pension level) of the pension system. A total of 40 parameters are considered, with values ranging from 1 (very good) to 7 (very poor). In the weighted sum of all parameters, the evaluation of the respective system crystallizes into one overall score.

No respite

The Corona pandemic has led to a decline in life expectancy in many countries; in a few, a (small) baby boom could even be registered. However, this is only a short-term interruption of the unabated and accelerating trend of societal aging, readable in the global old-age dependency ratio1: by 2050, it is expected to climb from 15.1% today to 26.3%; in 2019, an increase to "only" 25.3% had been forecast. "The latest data from China, Korea or Italy, for example, point to speedup of demographic change," said Michaela Grimm, co-author of the report. "In particular, birth rates are developing even worse than assumed, despite all family policy efforts. But it doesn't help to lament; we have to face the facts: The intergenerational contract has become fragile. The younger generations Y and Z in particular are being called upon to make (even) greater provision for old age themselves. The inconvenient truth is: they have to work longer as well as to save more and in a more focused way."

Busy standstill

The unweighted overall score for all pension systems studied is 3.6: barely satisfactory. Compared to our last report in 2020, this represents only a small improvement. On the one hand, this is hardly surprising: After Covid 19, war and the energy crisis, the fiscal space of most countries has narrowed even further. On the other hand, however, it is very disappointing: the need for pension reforms is not in dispute, but rhetoric is rarely followed by powerful action: work on the pension construction site is not progressing. In fact, only a few countries – such as France or China – have managed to significantly improve their scoring through reforms. France almost exemplifies the political dilemma of such reforms, as they turn the usual political economy on its head: Instead of handing out benefits today in exchange for impositions later, they require impositions today to avoid cuts later. The few pension systems that are doing well today – notably Denmark, the Netherlands and Sweden, with an overall score well below 3 (see table) – therefore also have one thing in common: they set the course for sustainability very early on, at a time when the demographic bomb was still ticking quietly. They can therefore serve as a model for many developing countries, who face the challenge to find the balance between increasing the adequacy and coverage of their pension systems on the one hand and guaranteeing their sustainability on the other.

Rethink

In addition to the technical details, such as contribution levels and periods, a major precondition for sustainable and adequate pension systems are labor market reforms, especially the reduction of informal employment and the adaption of the labor markets to the needs of a rapidly aging workforce population. New technologies are set to facilitate and spur this process at the same time, also in emerging markets: "Automation, digitalization and artificial intelligence are enabling universal access to education and thus new concepts of work. The dissolution of the rigid dichotomy between employment and retirement currently exists only for a privileged few. The pension system of the future starts by rethinking the world of education and work for all," said Ludovic Subran, chief economist at Allianz.

Region of different paces with common need for further reforms

The 15 Asian markets2 that we covered in our report are no exception to the rule. By 2050, the total number of people aged 65 and older in these countries is expected to more than double from 411mn today to 838mn in 2050, i.e., they will be home to more than half of the world’s 1.6bn people in retirement age. Driven by gains in further life expectancy on the one hand and declining fertility rates on the other, the average old-age dependency ratio in this group of countries is set to increase from 16% to 34%. While there are marked differences between the countries in the absolute levels of the old-age dependency ratios, which are expected to range from 15% in Laos to 79% in Hong Kong in 2050, all countries – besides already “old” Japan – have in common the rapid aging of their societies: In all of them the old-age-dependency ratio is set to more than double within a generation.

Against this backdrop, there is an urgent need to make the Asian pension systems demography-proof. The region’s average score in sustainability is slightly above the global average, 3.6 against 3.7, while the comparatively low score in adequacy of 3.7 points to the fact that many countries in the region have still to catch up in this respect.

The reform needs differ from country to country reflecting the development level of the pension system and the age structure of the society. In the mature markets, like Japan, Hong Kong, Singapore or South Korea, strengthening the pension system’s long-term sustainability gains in importance. This is reflected by the sustainability scores of the countries in our index, which are in most of the mature markets, besides South Korea and Taiwan, markedly below the global average of 3.7, ranging between 3.8 in Japan and 4.1 in Singapore. In contrast, the scores in adequacy are in all these markets above the global average of 3.4, ranging between 2.4 in Taiwan and 3.2 in Singapore. In the emerging markets with still rather young populations, like Cambodia, Indonesia or Laos policy makers face the challenge of improving the adequacy of the pension system, while maintaining its long-term sustainability at the same time. Recent reforms like the introduction of mandatory contributions in Cambodia or fostering private pension provision like in China will help to improve the adequacy of these pension systems. However, all countries have in common a relatively low mandatory or minimum retirement age that does not reflect the gains in life expectancy. Linking the retirement age to the development of life expectancy could help to improve the long-term sustainability of the pension systems.

In this context, pension reforms need to go hand in hand with labor market reforms. This holds not only true for the emerging economies, were it needs further efforts to improve the formalization of the labor market, since a large part of the working age population in these countries is still employed in the informal sector without any coverage by the social security system. It holds also true for the mature markets in the region, where the labor markets need to be adapted to the needs of a rapidly aging workforce population, especially against the background that further increases in retirement age to compensate developments in further life expectancy might become inevitable to improve the long-term sustainability of the pension systems.

Further reforms needed

With 3.7, Singapore ranges lower midfield in our index with the overall score hinting at further need for reforms. The city state has the highest living standard of the countries we covered in our analysis and a pension system that provides an above-average adequacy, scoring 3.2 in our adequacy sub-index. Although there is room for further improvement in terms of the coverage of the pension system for example. However, given the rapidly aging of the population, with the old-age dependency ratio set to almost treble from 22% today to 61% in 2050, it is especially the long-term sustainability of the pension system that gives reason for concern. In international comparison the retirement age in Singapore is still rather low, especially against the background that Singapore’s 65-year-olds have one of the highest further life expectancies in the world. Since the financial leeway to cushion the impact of demographic change on the pension system is rather small - despite the fact that the population is still rather young, the contribution rate in Singapore is already today one of the highest in the world, for example – further increases of the retirement age might become necessary to improve the long-term sustainability of the pension system.